amriphoto/E+ through Getty Pictures

Thesis

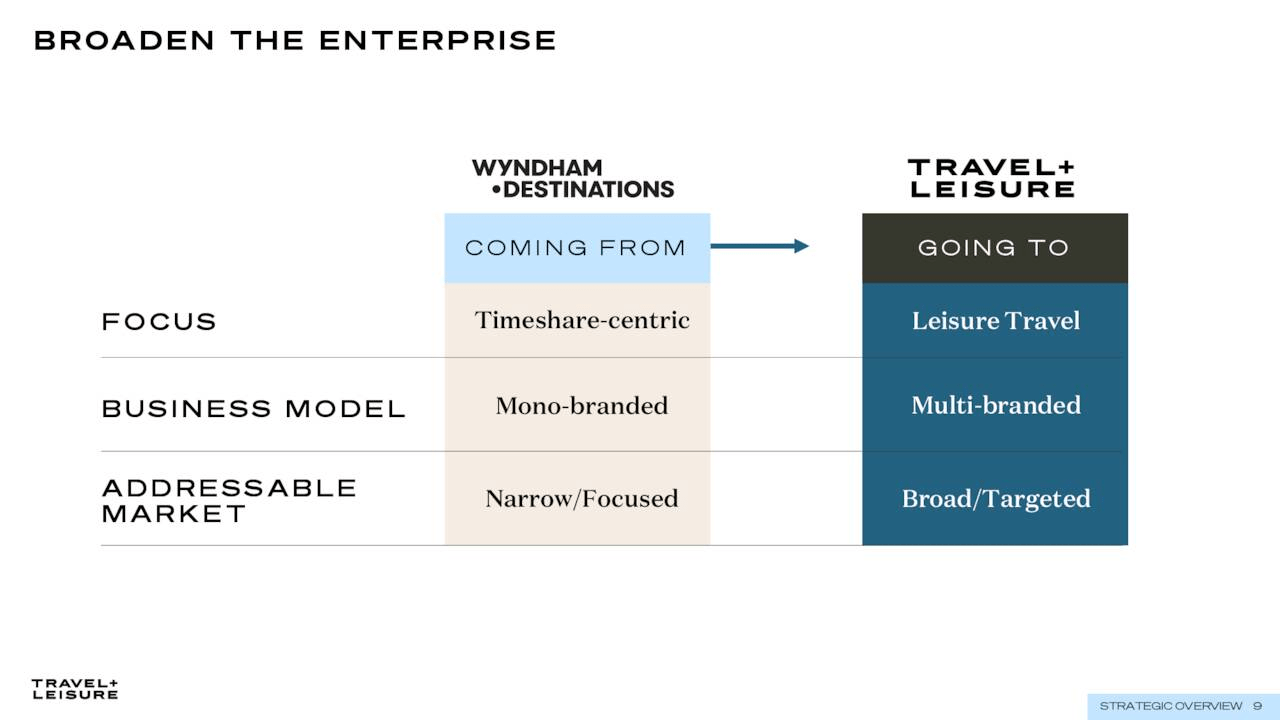

Travel + Leisure (NYSE:TNL) is very an intriguing new conglomerate in the travel market. Previously element of Time Magazine proprietor Meredith Co (GTN)(IAC), T+L the magazine was acquired by Wyndham Resorts (WH) spin-off Wyndham Locations, which are generally timeshare resort operations, but Wyndham took the well-known magazine’s name. The intention of the acquisition and rebranding beneath the T+L banner was for numerous explanations. Initial, move away from destructive timeshare stigma because of to rights and expense. Second, improve visibility of the platform under just one banner. 3rd, improve operational efficiency by means of integration, all when increasing client base. The businesses are now capable to do the job alongside one another, somewhat than together with every other, and administration expects these synergies to travel growth and revenue.

I be expecting the benefits to be favorable, but there is a great deal of competition in the “lifestyle journey” segment, such as Airbnb (ABNB). As buyers, it will be significant to choose areas of the sector that are at present weak, but supply upside possible as overall performance returns to form. The uncertainty about TNL presents a steep undervaluation all even though synergies involving functioning units will let the firm to outperform. Whilst fiscally the jury is nevertheless out, the investment decision is absolutely well worth thing to consider about the up coming couple of quarters many thanks to the favorable valuation.

TNL

The New Vacation + Leisure

Prior to merging, the two independent entities were very specialised, a single a timeshare supplier and the other a journey journal. With print media taking a strike above the past couple decades, maybe as a end result of declines in political desire, Travel + Leisure invested intensely into their on the net system. Also, the manufacturer proceeds to supply annually award rankings of the leading accommodations, destinations, and areas of the earth. The publication is often rated as the best top quality identify in the marketplace and has attained lots of lovers the world more than. Completely, if journey acceptance will increase to levels seen prior to the pandemic, T+L is set to develop with the market place. On the other hand, timeshares are a distinctive story as their monetary viability and popularity wanes more than time, particularly with steep levels of competition from vacation rentals and conventional hotel/motel.

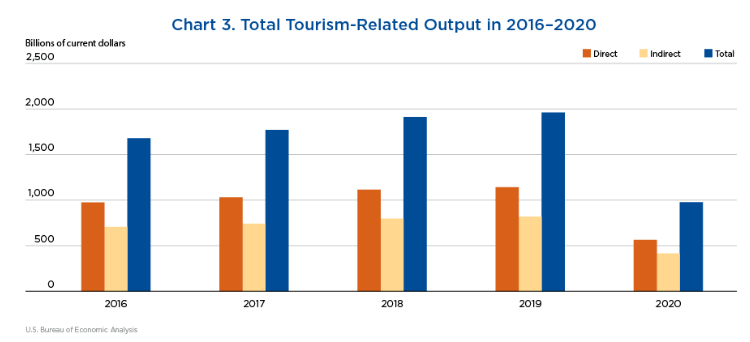

USBEA

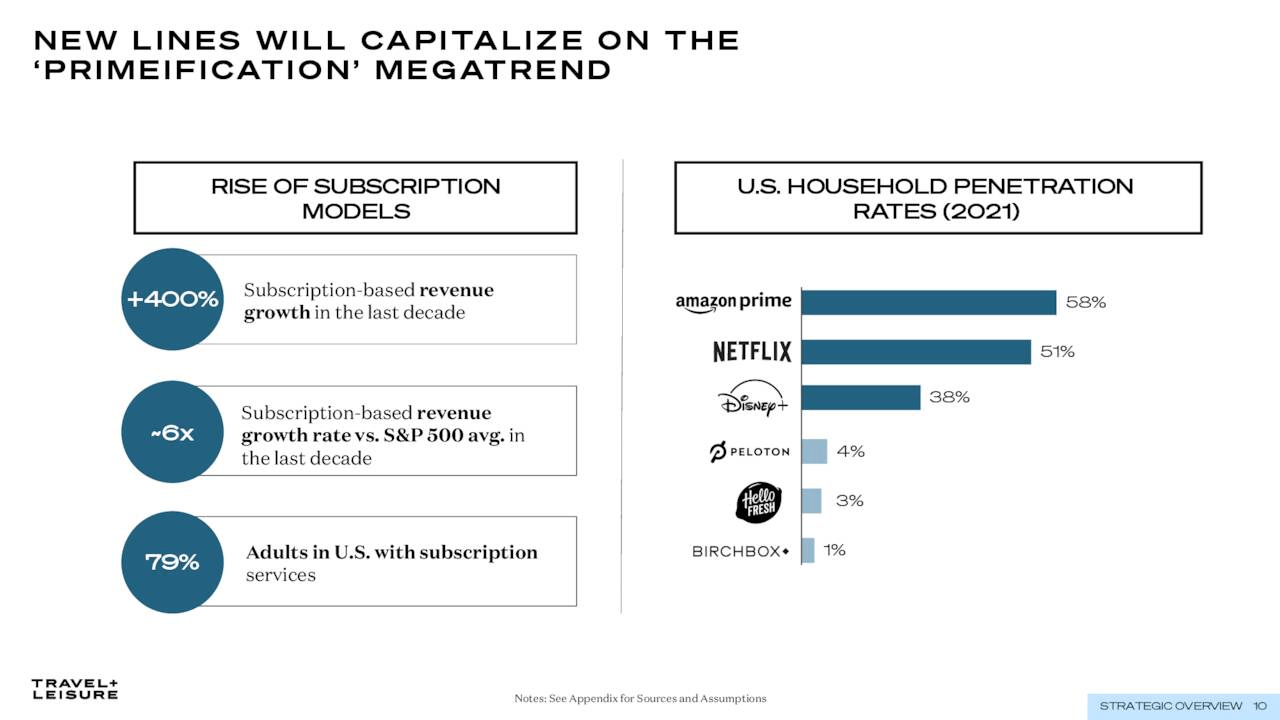

To tackle some troubles, the business is shifting organization techniques, opting to go with the well-liked membership product. This features the a variety of Wyndham Locations Golf equipment, Journey + Leisure Club, and Travel + Leisure Go. Wyndham Club and some others, backed by the considerable catalog of timeshares within just the RCI system, now enable customers to opt for many resorts, fairly than remaining stuck at a solitary just one. Making use of a factors design, various tiers of memberships have various awards, but customers get locked into extensive-phrase contracts.

To have a lot more lenient and considerably less baffling choices, TNL now offers Vacation + Leisure club, a now $15 ($19.99 when not on sale) every month subscription that offers obtain to journey bargains, private concierge, and curated itineraries. This membership is not contracted and can be canceled at any time. Nevertheless, this system even now favors additional affluent consumers who are capable to vacation a lot more usually, significantly like timeshares or travel credit card rewards.

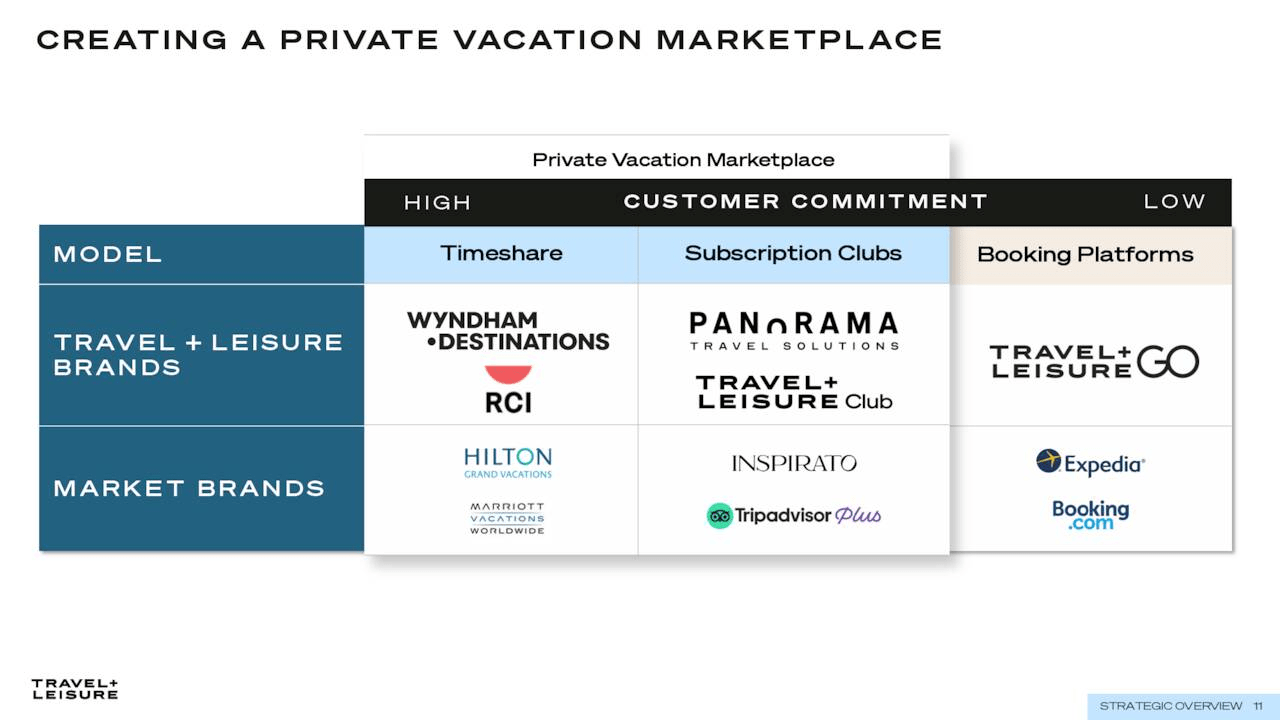

As such, a 3rd assistance platform was additional, TNL Go. The web site gives extensive and a lot of itineraries for tourists and commonly presents inbound links to sign up for TNL Club. While a lot more of an middleman involving the magazine site and club, perhaps the firm will glimpse to set up on the net scheduling capabilities related to Reserving.com (BKNG) or Expedia (EXPE). The corporation also gives the Panorama software system that enables condominiums, residences, and/or resorts and other trip rentals to have their possess site platform for bookings.

There are other pieces I could talk about, but the gist is that the magazine web site drives targeted traffic and the need to travel, then first vacationers will glance at itineraries on the T+L Go website. Following enjoying a family vacation, individuals who want to proceed touring or vacationing through the year will be part of T+L Club. Then, the top-tier of earners or retirees with added cash flow will be the most important purchasers of timeshare club memberships. This favourable suggestions loop permits for the synergies concerning models that I mentioned before. While, a single will have to be considerate of extra expending on the tech platforms, and a single consolidated internet site or membership might be greater. I am positive the business will evaluate this contingency as properly.

TNL

TNL

Financials

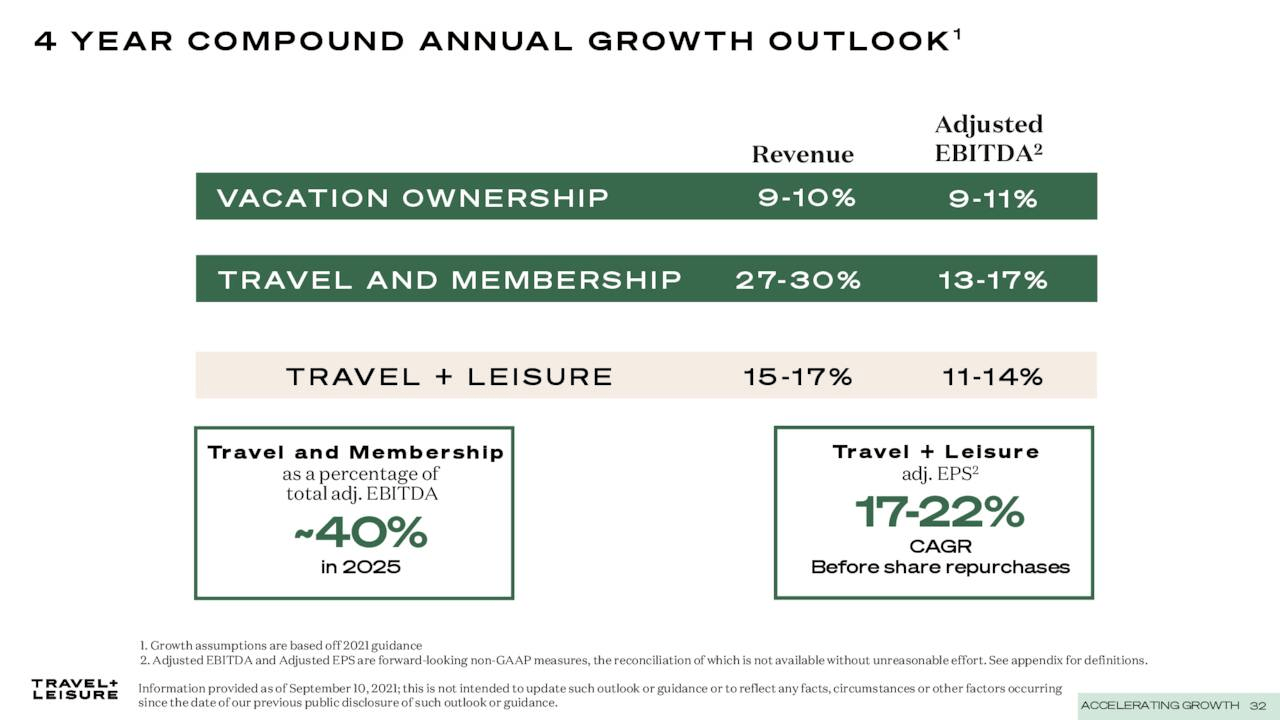

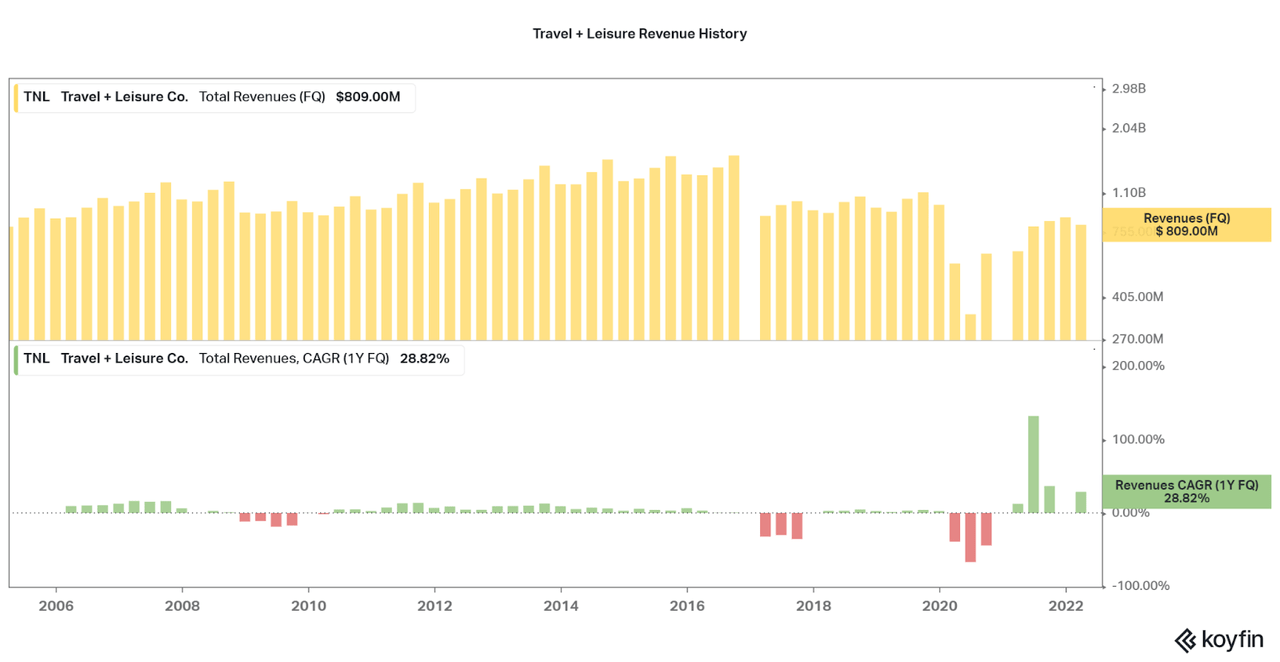

So, how do these changes affect the financials? While the enterprise expects considerable growth more than the next 4 yrs, we can make little insights into whether this is further than prior performance. So significantly, revenues have rebounded to a bit considerably less than 2019 revenues, and are a lot less than what the Wyndham company observed on its personal prior to merger. Nonetheless, most travel field names are still receiving much less revenues than prior to the pandemic. As these, I think it will just take some time to be able to crack down the revenues and progress opportunity of the enterprise.

For the second, the driving catalyst will only be a return to pre–pandemic travel levels. Troubles with inflation and recessions will also hinder the inventory, so the return will probable be slower than anticipated. Nonetheless, in the extended operate, I do not feel the corporation will return to the profits growth witnessed in the 2010-18 time period, and will in point expand a lot quicker.

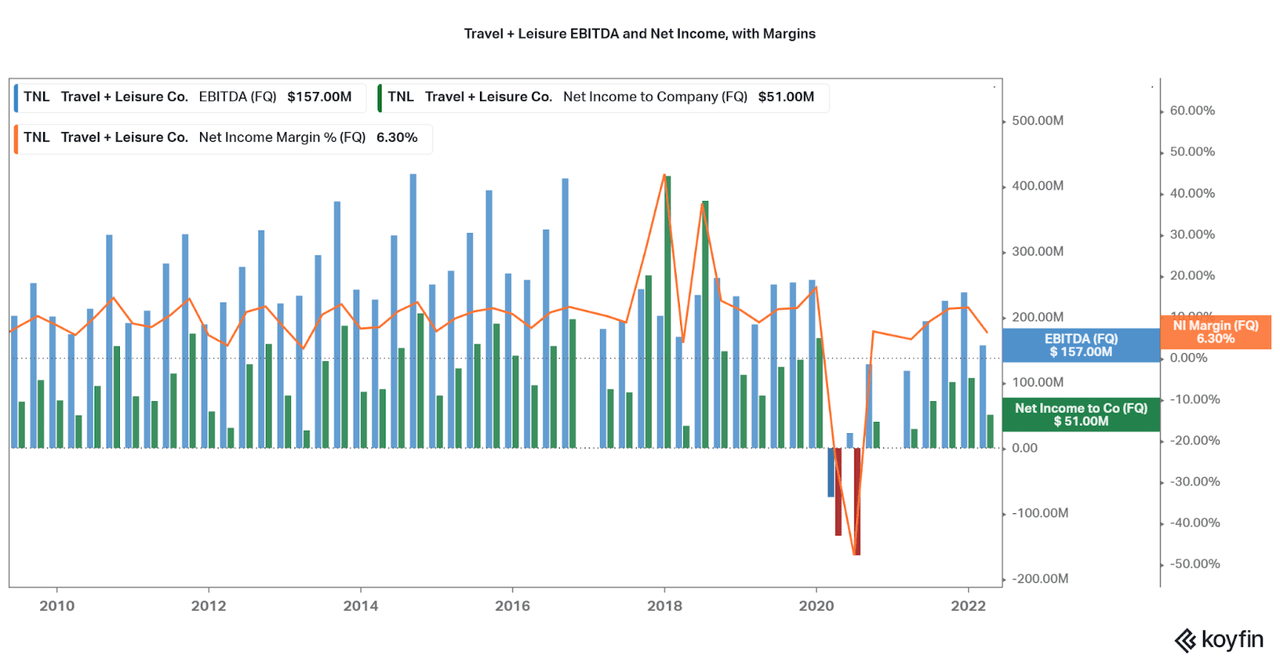

TNL Koyfin

When 2020 was achieved with steep losses at first, I uncover that T+L was capable to keep solid profitability for the duration of the later levels of the pandemic. In truth, two quarters ended up detrimental, but then by 2021, the web profits margin returned over 5%, with some quarters hitting 10%. The timeshare business has a history of sluggish, but rewarding growth, and it would seem this sample allowed for basic safety into 2021. I also believe that the magazine phase remained powerful as very well, as the wish for journey material did not subside, just the capacity to vacation I know I prepared out lots of excursions for after I could journey all over again over the previous two many years.

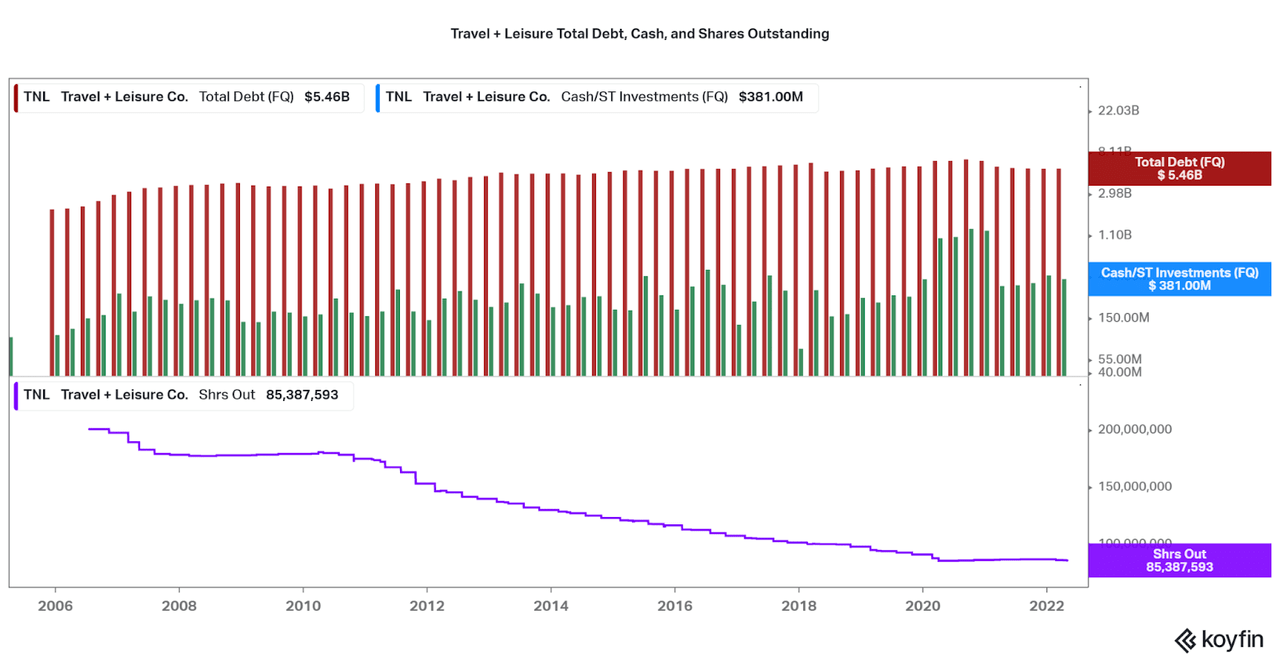

Koyfin

Taking a appear at the stability sheet also paints a contrasting photo. Even though there is important financial debt on the equilibrium sheet, dollars concentrations really enhanced in 2020/21. I like to see that debt is not growing as a result of the pandemic, and this might be a favourable gain to the newly merged businesses. Even further, the business had a historical past of steadily decreasing the in general share count, and dilution did not arise through the pandemic. When I consider TNL delivers a harmless harmony sheet, I would continue to preserve look at alongside with the relaxation of the financials as journey returns to ordinary. There is much uncertainty in the marketplace and economy, and no require to rush into an expenditure.

Koyfin

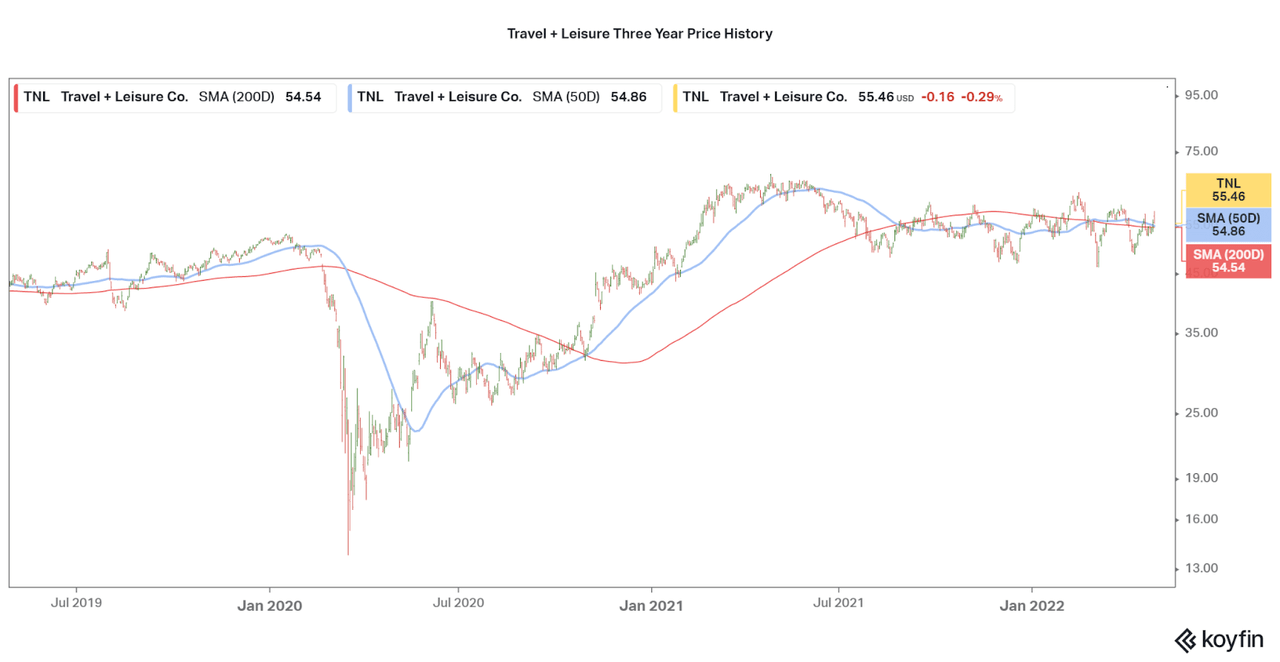

Price and Valuation

As the enterprise has experienced a large change with their inner construction, and the pandemic strike at the worst time, TNL‘s share rate has failed to access highs observed prior to the pandemic. There was an original surge alongside with valuations previous summertime, but this quickly fell later on, while a keeping pattern has emerged involving $40 and $60 for each share. Even though it is rather noticeable to traders that they should really have bought in the course of pandemic lows, we can also appear at the valuation of the enterprise as possible support for the expense.

Koyfin

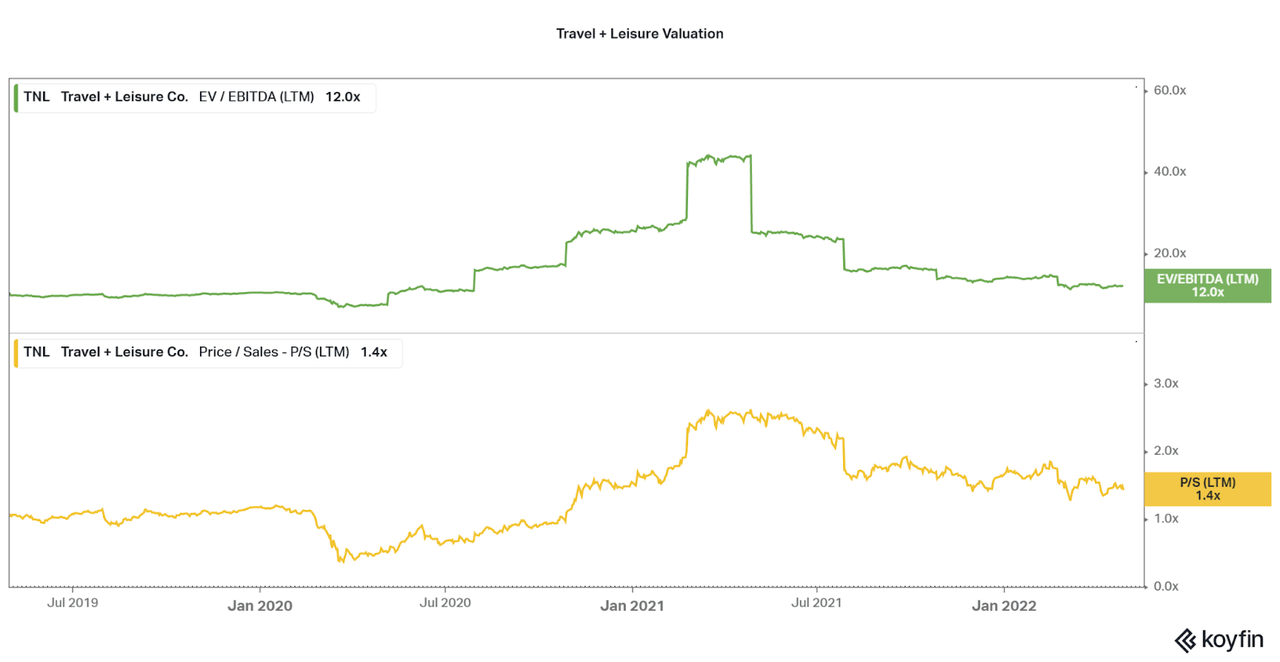

When the rate to earnings chart presents minor insight and is excluded, the present P/E of TNL is a meager 14.5 (TTM, GAAP). This indicates the industry is pricing in very little growth for the enterprise, even as overall performance returns. This is highlighted by the EV/EBITDA price of 12.0x, slipping steadily considering the fact that previous summer months. Further more indicators of weak spot are in the P/S, but due to the decreased revenues, remains higher than lows of 2019 and 2020. Any favorable profits growth and preserved profitability will swiftly push the valuation lessen. As an investor, it will be important to assess whether or not values will proceed falling, remain the exact same, or extend. Even so, I like not to gamble, and I would consider the company entering into truthful or small valuation territory from below.

Koyfin

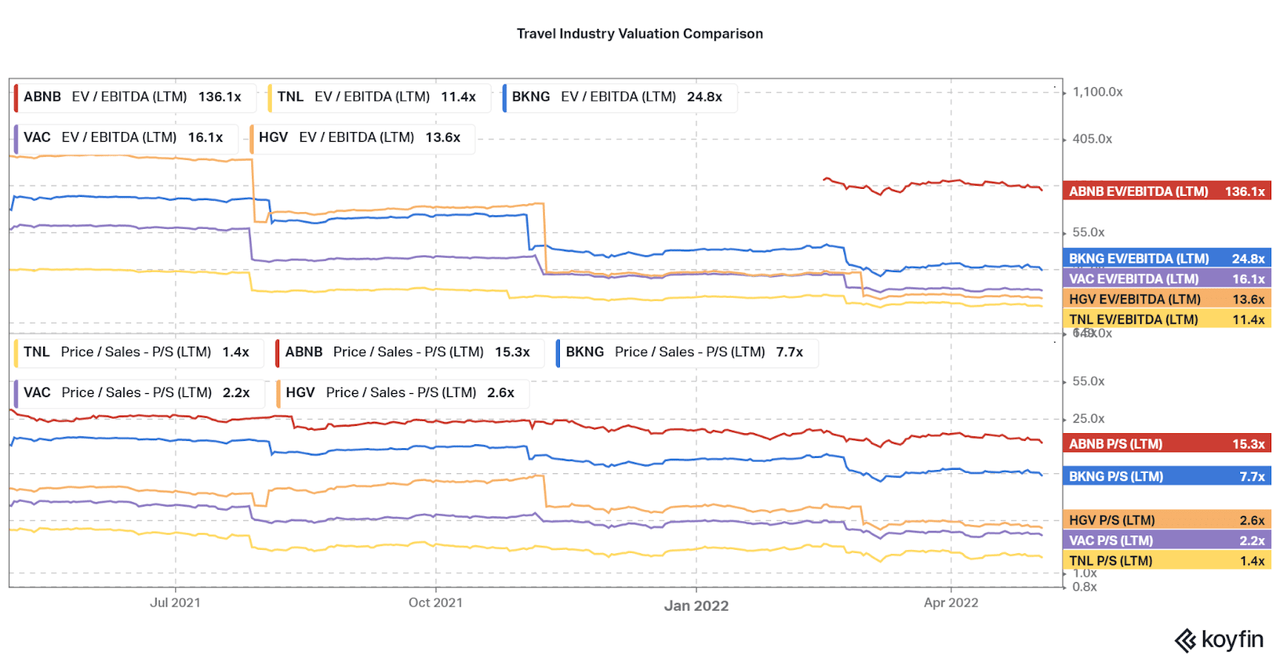

A further way to evaluate Journey + Leisure is by comparing the valuation to friends. Whilst general performance is hard to assess because of to TNL‘s new status, it is simple to see that the enterprise holds a much decrease valuation than any peer in the travel business, even other timeshare or itinerary vendors this sort of as Hilton Grand Holidays (HGV) and Marriott Vacations (VAC). Meanwhile, booking platforms this sort of as Scheduling.com and Airbnb keep far larger valuations, even as their individual development prices falter. In this existing current market period, rewarding, steady expansion will hold a greater valuation, and this favors T+L as tourism returns in time. Of program, all of these names present a bit unique exposure to the market place, and need to also be assessed for their possess merits.

Koyfin

Summary

I believe that Journey + Leisure is one particular of the extra distinctive shares in the travel field, and certainly value thought at latest valuations and upside opportunity. While problems about even further COVID variants, global vacation, and even a economic downturn weigh weighty on the outlook, T+L appears to be to be undertaking well now that they are blended with Wyndham Locations. Also, a rebranding of timeshares, and a reduction in their unfavorable characteristics (these types of as non-cancelable contracts), will permit for a resurgence of the business better than with friends. The newly recognized opinions loop of building drive to vacation (magazine/web site), providing vacation scheduling and concierge support (T+L Club), and then finally the increased price timeshare ecosystem for people who want the comprehensive practical experience, is a constructive catalyst for the firm‘s opportunity. Even though I will be sitting on the sidelines for the instant, I might see an option to obtain if the share value goes down considerably additional.

Many thanks for reading through, allow me know what you assume in the opinions.